what does a stock being oversold mean

Traders typically use the RSI as a technical indicator but individual investors typically use the. Oversold stock meaning An oversold stock means that a companys shares are currently under heavy selling pressure but have the potential to bounce back.

Oversold Markets 4 Things To Consider

It might have a temporary mar on its name or.

. Some technical indicators and fundamental ratios also. Oversold is a term used to describe when an asset is being aggressively sold and in some cases may have dropped too far. While the sell-off has caused its share price to decrease.

When a stock is oversold it trades at a price below its intrinsic value. Its a technical term an oversold stock means the stock has been sold way too much and its considered a good time to buy usually for swing traders for short term gains. Put simply it trades at a price thats much lower than it should.

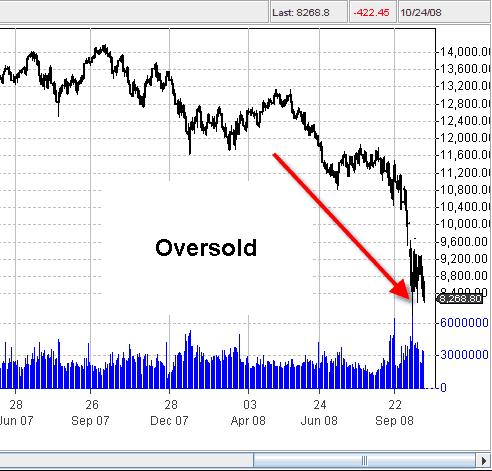

If a stock is oversold it means that the number of sellers outweighs the number of buyers. The oversold market shows that the asset is trading below its fair value. Oversold refers to a market state when prices have gone down excessively and therefore are likely to reverse to the upside in the near future.

An overvalued stock has a current price that is not justified by its earnings outlook known as profit projections or its price-earnings PE ratio. When a stock is fundamentally oversold this would tell us that investors claim the assets are being sold under their true or usual value. Consequently analysts and other.

This means that its worth much more than. Oversold stocks can be a great opportunity to make gains. Technical indicators like RSI stochastic oscillator and on-balance.

An oversold stock means that a companys shares are currently under heavy selling pressure but have the potential to bounce back. When a security in the stock market is oversold this means that the securitys price has dropped below its true value in a short period of time often as a result of massive selling. Why does a stock become oversold.

If the RSI is above 70 it is said to be an indication that the stock is overbought. The price reaches extremely low levels and then it reverses. This stage of the stock.

If you measure a stochastic value nearer towards a value of 100 then the prices were at their highest during that time frame. This can happen for many reasons such as. Oversold is a market condition where an asset is trading below its actual price with a huge potential for price bounce.

Although oversold is mostly. When you buy an oversold stock you might be investing in a well-known company. It happens during a long downtrend.

There are plenty of reasons why this could happen. A low RSI generally below 30 signals traders that a stock may be oversold. Essentially the indicator is saying that the price is trading in the lower third of its recent price.

Following a phase where a stock has seen prices drop substantially in a short time ie prices moving down too far too fast the stock tends to become oversold. However if theyre valued at 80 or above your stock is likely.

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

Oversold Stocks Most Oversold Stocks Today

Overbought Vs Oversold And What This Means For Traders

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Oversold Stocks Screener Marketvolume Com

Oversold Meaning Indicators Examples Vs Oversold

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

How To Find Overbought Or Oversold Stocks Easy

How To Determine Overbought And Oversold Conditions And Trade Profitably Bullbull

Oversold Stocks Short Term Marketvolume Com

/dotdash_Final_Overbought_or_Oversold_v1_Use_the_Relative_Strength_Index_to_Find_Out_Oct_2020-01-423bbf70a2224158a165ae090b8277ae.jpg)

Rsi Indicator Evaluate Stocks As Overbought Or Oversold

Determining Overbought And Oversold Conditions Using Indicators

Overbought Vs Oversold And What This Means For Traders

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)